Why European Mining Machine Hosting Prices Are Rising and How to Adapt

The hum of the cryptocurrency mining industry, once a low thrum resonating primarily in regions with cheap electricity, is now facing a new, higher pitched note in Europe. Hosting prices for mining machines are on the rise, forcing miners to adapt, innovate, and rethink their strategies. But why this surge, and what options remain for those seeking to unearth digital gold in the Old World?

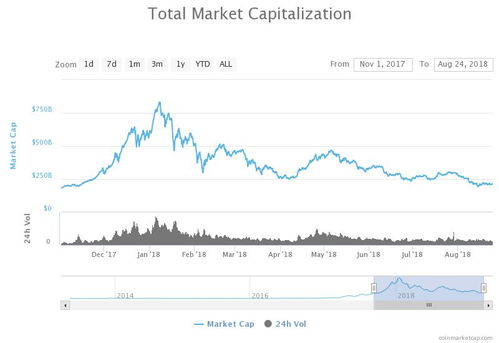

Several factors contribute to this price hike. The escalating cost of energy across Europe, spurred by geopolitical instability and a renewed focus on renewable energy sources (which, while sustainable, can be intermittent and location-dependent), is a primary driver. Energy-intensive operations like cryptocurrency mining are particularly vulnerable to these fluctuations. Furthermore, increasing regulatory scrutiny, varying across different European nations, adds compliance costs and operational complexities for hosting providers. Stricter environmental regulations, focused on carbon emissions and energy efficiency, necessitate investments in greener technologies and practices, ultimately passed on to the consumer. Demand also plays a crucial role; as Bitcoin and other cryptocurrencies gain wider acceptance, the demand for computing power, and therefore mining, intensifies, driving up prices where supply is constrained. Space, a perennial premium in many European countries, further exacerbates the issue. Finding suitable locations with sufficient power infrastructure, cooling capabilities, and security measures presents a significant hurdle, especially near population centers where demand is highest. Let’s not forget the ripple effect of global supply chain disruptions, impacting the availability and cost of essential components for mining rigs and infrastructure.

So, how can miners adapt to this evolving landscape? Diversification is key. Relying solely on a single hosting provider or a single cryptocurrency is a risky proposition. Exploring alternative energy sources, such as solar, wind, or even geothermal, can offer a degree of independence from the volatile energy market. Strategic location selection is also crucial. While major metropolitan areas may command premium prices, exploring less developed regions or countries with lower energy costs can yield significant savings. For instance, some Eastern European nations still offer relatively competitive rates. Furthermore, investing in more efficient mining hardware is a long-term solution. Newer generation mining rigs are significantly more energy-efficient than their predecessors, reducing operational costs and environmental impact. Participation in mining pools can also mitigate risks and provide more predictable returns compared to solo mining. Collaboration with other miners can create economies of scale, allowing for collective bargaining power and access to resources that would be unattainable individually. Exploring alternative cryptocurrencies, beyond Bitcoin, is another avenue. While Bitcoin remains the dominant cryptocurrency, others like Ethereum (after its transition to Proof-of-Stake, however, mining is no longer relevant), Litecoin, or Dogecoin can offer profitable mining opportunities, depending on market conditions and hardware capabilities. Finally, and perhaps most importantly, staying informed about regulatory changes and technological advancements is paramount. The cryptocurrency landscape is constantly evolving, and miners must adapt quickly to remain competitive and compliant.

The rise in European mining machine hosting prices presents a challenge, but also an opportunity. By embracing innovation, diversification, and strategic planning, miners can navigate this evolving landscape and continue to unearth digital gold in a sustainable and profitable manner. The future of cryptocurrency mining in Europe hinges on adaptability and a willingness to embrace new technologies and approaches. Consider the impact of proof-of-stake mechanisms on the future of mining in general, as Ethereum’s shift demonstrates. This has led to increased interest in alternative consensus mechanisms and cryptocurrencies that still rely on proof-of-work, potentially influencing the demand for mining rigs and hosting services in different regions.

You may also like

1 comment

Leave a Reply Cancel reply

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

European mining hosts surge amid energy woes. Adapt by exploring renewables, relocating strategically, or upgrading efficiency for profitability. Future-proof your operation now!