Harnessing Power: Reviews of Bitcoin Mining Hardware for Profitable Ventures

In the ever-evolving landscape of digital currencies, harnessing the raw power of Bitcoin mining hardware stands as a beacon for those seeking profitable ventures. Bitcoin, the pioneer of cryptocurrencies, has captivated investors and tech enthusiasts alike with its decentralized ethos and potential for substantial returns. As companies specialize in selling and hosting mining machines, understanding the intricacies of this hardware becomes paramount. From the hum of high-performance rigs to the strategic placement in mining farms, the journey to profitability is both thrilling and demanding. This article delves into reviews of top-tier Bitcoin mining hardware, weaving in insights on various cryptocurrencies, exchanges, and the broader ecosystem that supports this digital gold rush.

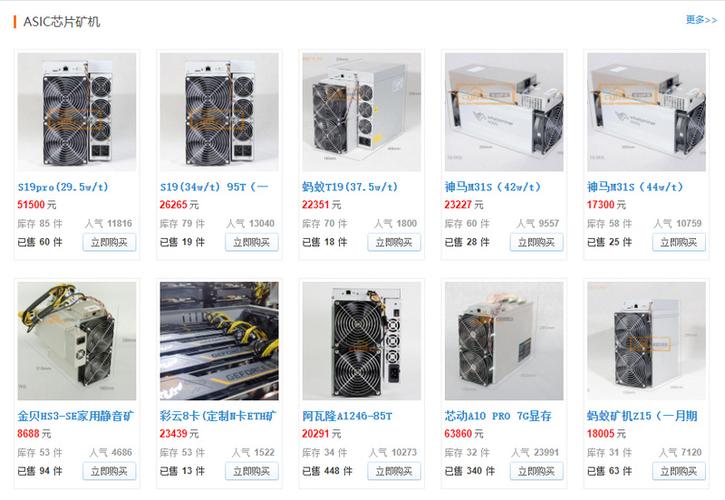

At the heart of Bitcoin mining lies the mighty ASIC miners, specialized machines designed to solve complex cryptographic puzzles with unparalleled efficiency. Take, for instance, the Antminer S19 series, a favorite among professionals for its robust hashing power reaching up to 110 TH/s. These devices not only excel in Bitcoin mining but also adapt to other proof-of-work cryptocurrencies like Ethereum Classic, offering a versatile edge in a fluctuating market. The burst of energy these miners unleash is matched only by the strategic decisions of where to host them—be it in dedicated mining farms or through services that handle the logistics, allowing users to focus on returns rather than maintenance. With exchanges like Binance or Coinbase facilitating seamless transactions, the profitability equation becomes more dynamic, influenced by factors such as electricity costs and network difficulty.

Transitioning to other digital assets, Ethereum’s shift towards proof-of-stake has altered the mining scene, yet hardware like GPU-based rigs remains relevant for coins such as Dogecoin. Dogecoin, with its lighthearted origins and surprising market surges, can be mined using less intensive setups compared to Bitcoin’s ASIC dominance. This diversity in hardware options—from simple home rigs to industrial-scale miners—highlights the adaptability required in modern crypto ventures. Hosting services, often provided by companies versed in this domain, offer secure facilities equipped with cooling systems and stable power, mitigating risks for enthusiasts venturing into multi-currency mining. The rhythm of the market, with its unpredictable bursts and lulls, demands that miners stay informed about exchanges and wallet integrations to maximize profits.

Mining farms, vast arrays of synchronized hardware, represent the industrial side of cryptocurrency extraction. These facilities, buzzing with rows of miners, optimize for energy efficiency and collective hashing power, making them ideal for large-scale operations. A prime example is a rig setup featuring multiple units like the Whatsminer M30S, which balances cost and performance for Bitcoin and similar networks. Yet, the allure of individual miners cannot be overlooked; solo enthusiasts often start with a single device, learning the ropes before scaling up. This progression mirrors the burstiness of the crypto world, where sudden price spikes in assets like ETH can turn a modest setup into a profitable endeavor overnight.

As we explore the profitability of these ventures, it’s essential to consider the environmental and economic implications. Bitcoin’s energy consumption has sparked debates, pushing innovations in hardware design towards more sustainable models. Companies offering mining machine sales and hosting services are at the forefront, providing eco-friendly options that reduce carbon footprints without sacrificing output. Exchanges play a crucial role here, enabling quick conversions of mined coins into fiat or other cryptos, thus locking in gains amid volatility. Whether you’re delving into BTC, DOGE, or ETH, the key lies in selecting hardware that aligns with your strategy, ensuring a harmonious blend of power, cost, and potential rewards.

In conclusion, the world of Bitcoin mining hardware is a tapestry of innovation, risk, and reward, intricately linked to the broader cryptocurrency ecosystem. By leveraging reviews and insights into miners, rigs, and hosting solutions, individuals and businesses can navigate this complex terrain with greater confidence. As the market continues to evolve, with new currencies and technologies emerging, the power harnessed today could pave the way for tomorrow’s profitable ventures. Remember, in this digital frontier, diversity in approach and a keen eye for opportunity are your greatest assets.

You may also like

1 comment

Leave a Reply Cancel reply

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

Bitcoin mining hardware reviews spotlight devices like the Antminer S19 as game-changers for profits, amplifying hash rates and ROI in volatile markets. Yet, their energy-guzzling nature risks environmental backlash, urging savvy investors to balance power with sustainability.